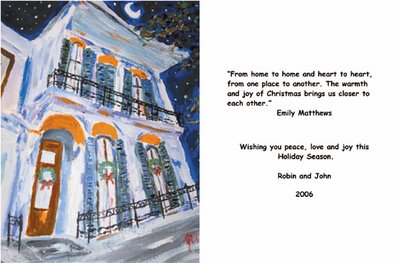

This is a painting I did after returning from New Orleans. My lovely wife crafted the words. Our wish is that each and everyone of you enjoy the season!

A Realtor is the artist that creates a smooth transaction when you are buying or selling a home. I am a Realtor and hope that by sharing random articles, I can remove the shroud that seems to cover the things real estate agents say and do. I believe in education and this collection is my personal effort to expose little known facts to the public at large.

Psychology of Money Drives Housing Market

Studies of the psychology of finance indicate that emotions play a huge role in decisions people make about money.

"There's a whole emotional processing system that goes on in the brain that's largely beyond our control," says Kevin McCabe, a professor of economics, law, and neuroscience at George Mason University in Fairfax, Va. "The general view is that our emotions control us, and not vice versa."

The study of neuroeconomics has illuminated a few key concepts: Many people will pass up sure profits for illusory ones. Some will turn down profits if they believe someone else is unfairly profiting more. Some will even refuse to sell if they believe they may come to regret it, because fear of future regret can be as powerful a motivator as money in the pocket today.

While little of this has been applied scientifically to real estate, it is easy to make the leap.

For instance, much research has been done on the concept of "loss aversion," which shows that people tend to deny reality when something they own, such as a house, declines in value. Sellers maintain the asking price even at a level that makes no sense, economists say. Similarly, home sellers become attached to the prices their neighbors received at the top of the market rather than current prices, and they become reluctant to sell unless they get that higher price.

"There seems to be a psychological resistance to taking losses on the sale of a house," says David Laibson, who teaches psychology and economics at Harvard University. "People think they'll make money on it....That logic worked for a long time, and now anyone who bet on that logic is being burned."

Source: The Washington Post, Kirstin Downey (11/04/2006)

As a Realtor, I have the chance to meet many people seeking a new home. I am fortunate in that they come to me from many sources. Some are referred by clients, some walk in the door of the office, some have read this blog and others come from various lead generation programs that I use.

The size and price of the home they are seeking varies. The ethnicity of the clients vary. The age of the clients spans the spectrum. One thing remains constant. It doesn't vary. Everyone includes the feeling, and I will paraphrase here, I want a safe neighborhood.

As a Realtor, I am bound by a code of ethics. I am old enough to remember a country much more divided than today. As a young man I witnessed the changes in our laws that were brought about by the various legislation created following the work of Robert Kennedy and Martin Luther King. Those changes began almost thirty years ago.

Our code of ethics dictates that we show homes in the price range and style that our clients request. These guidelines are proper and necessary to ensure our country continues in the direction of equality.

If the issue of schools comes up, we are directed to advise clients that they can check with the local school board for any information. If the issue of crime comes up, we are directed to advise clients that they can check with the local police station for that information. If the issue of zoning or changes in the master plan come up, we are directed to advise our clients that they can check the local planning office for that information. Each of these agencies has the facts and a consumer should have the facts when making a decision about where they choose to live.

Many clients respond to the reply "you have to go to ......(fill in the appropriate agency) and check on that" with a quizzical look that reads "what am I paying you for?????". To those that share that look, I am doing my job and making sure that you make one of the biggest financial decisions of your life based on the facts.

I mentioned Robert Kennedy and Martin Luther King. I don't know what else they could have accomplished. No one does. They were both taken from us and our possible future was stolen by men with guns. The Civil Rights bills were passed by Lyndon Johnson with the emotional support of a congress on the heels of the assasination of John Kennedy. In my lifetime, I have lived through the loss of our best and our brightest to guns and violence. They are only the tip of the iceberg.

I have heard both sides of the debate regarding gun control. I am so tired of the propoganda that supports the thought that James Madison wrote the Bill of Rights so that sociopaths, crazy people, angry people and racists could open fire and slaughter innocent men, women and children with handguns, assault rifles, uzi's, mak-10's, etc is one of the most despicable theories ever crammed down the throat of it's potential victims.

The statement that if citizens can no longer own guns then only criminals will have guns is emotionally charged rhetoric. The same paraphrasing can be put on any law. Is this any different, if citizens can no longer kill one another then only criminals will kill. Laws are written to dictate behavior and identify those that do not comply and in the end laws are used to prosecute those that do not conform.

Safe neighborhoods are everywhere and they are nowhere. If the NRA and the rest of the gun lobby is allowed to buy and secure votes on a national level, the change must come locally. It must begin with you.

A change in gun laws will not guarantee all neighborhoods will be safe. Such a law will just remove one of the tools we currently use against one another.

I can still remember a time when children played in neighborhoods and the worst thing a child might face in school was the reprimand following "my dog ate my homework."

More listings increases the amount of time that a Realtor have to spend servicing listings. Yes Virginia, not only is there a Santa Claus, today, more than ever, it takes more than a sign in the yard and fresh cookies during an open house to get the house sold.

The pool of buyers remains constant, but the increase in inventory has ended for now the need to write an offer on the hood of a car in an effort to beat the competing offers. If the house a potential buyer likes goes under contract, there are many more available quite similar to that one.

I suppose with interest rates up and prices still holding, some folks feel that maybe they can negotiate a better deal on their own and save "commission". I hope that they realize that if they allow the agent selling the house to handle "both sides of the deal" - they have no representation.

The agent selling a home in Maryland CAN NOT represent anyone but the individual selling the house. They may talk fast and gloss over that fact and point out that they can cut their commission to save the buyer money, but the fact is - they are working for the seller and they CAN NOT offer any advice or counsel regarding price or anything else about the home that is not public knowledge.

It would seem that the the hesitancy to act is related to the amount of homes on the market. If we buy this one, we may have missed a better home. Maybe we should look at a few more? The fallicy in that logic is plain to see for a Realtor and is lost in the haze of so many homes seen by the buyer. If you have found a house that you feel can be home, buy it. If you wait, it will be gone. It is far worse to spend the next 10 years in your second choice bemoaning the fact that you could have had your first had you written an offer.

The Fall Market is beginning and we are seeing an increase in activity. Sales in Montgomery County are down 26% but prices have risen around 5%. Those that have waited all Spring and Summer for prices to crash need to reconsider that plan and act before Fall turns into Winter and the home they have been watching is occupied by a new family.

I have to share, my wife and I had our eyes on a home we wanted to purchase. We watched and waited. We watched and waited some more. The other morning, to my horror, the house went under contract. It did not sell for less. The seller got their asking price and I am faced with a long winter of "Honey, why didn't you make an offer? Now some stranger is living in MY house!"

I should have listened to my own advice.